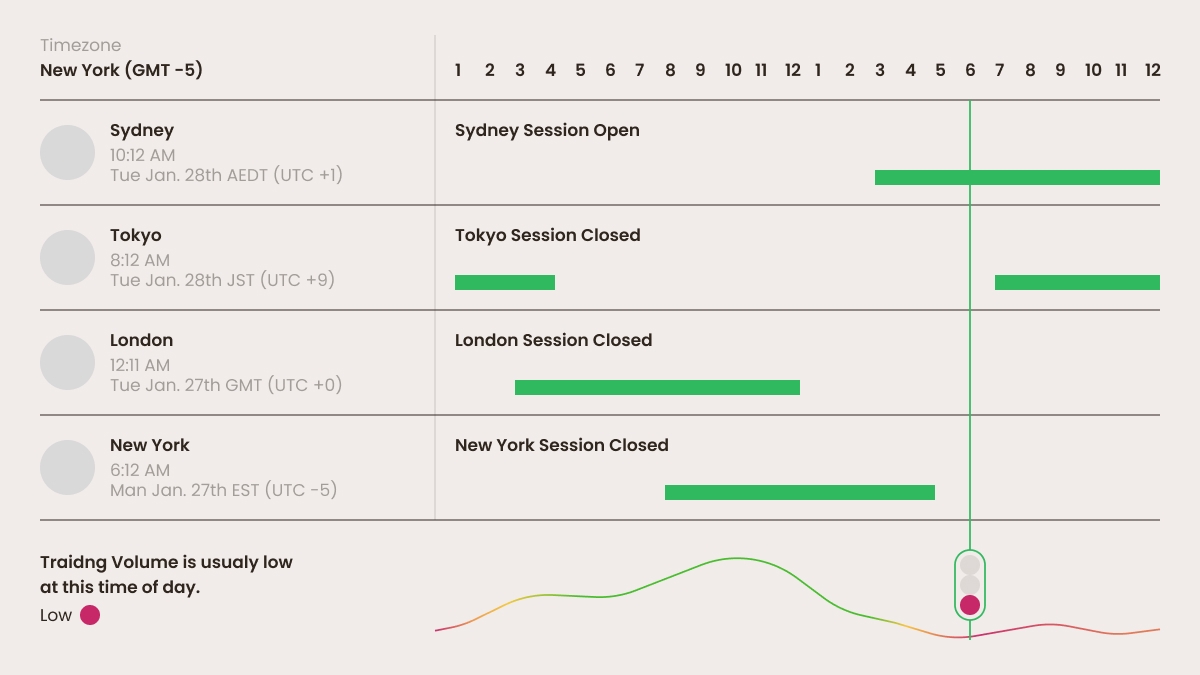

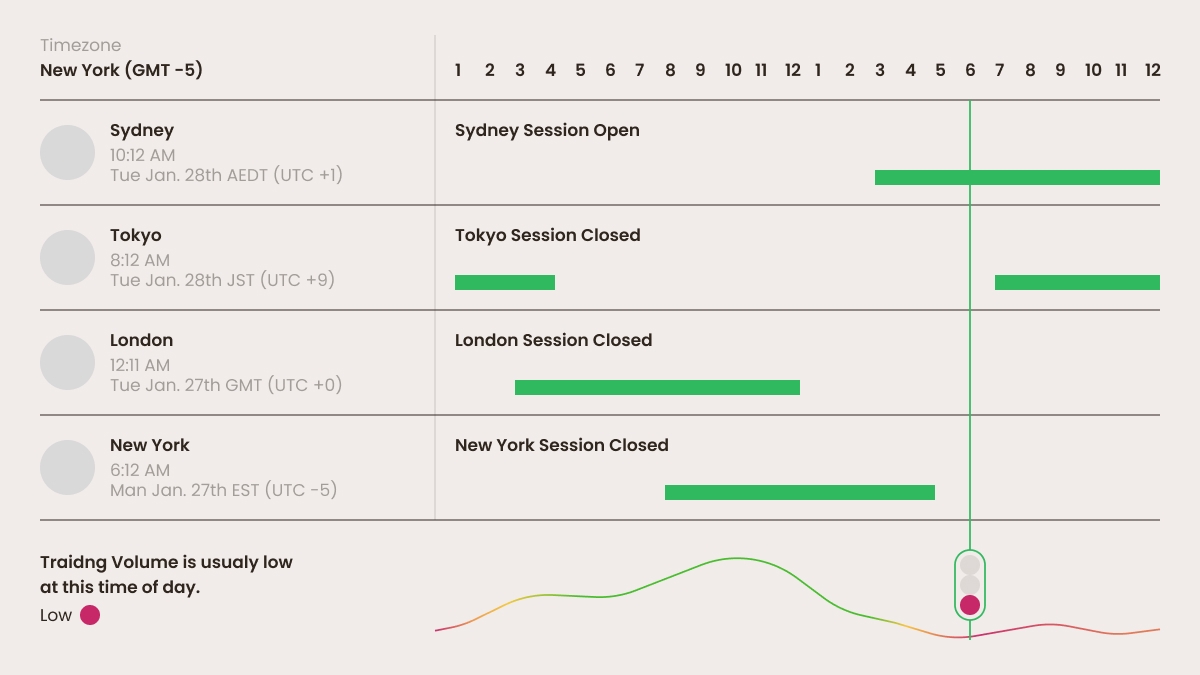

The forex market sessions

The forex market operates 24 hours a day, five days a week, allowing for trading across different time zones. Here’s a basic outline of the main trading sessions and their business hours in Greenwich Mean Time (GMT):

Sydney session

Opens at 10:00 PM GMT

Closes at 7:00 AM GMT

Tokyo session

Opens at 12:00 AM GMT

Closes at 9:00 AM GMT

London session

Opens at 8:00 AM GMT

Closes at 5:00 PM GMT

New York session

Opens at 1:00 PM GMT

Closes at 10:00 PM GMT

Tip: To find the session times in your timezone, add or subtract the appropriate number of hours relative to GMT. Always check for daylight saving adjustments, as they can affect the exact times.

Each of these sessions can overlap with others, particularly the London and New York sessions, creating some of the most active trading periods.

Session characteristics and how to capitalize on them

Trading forex during different times of the day can require different strategies due to varying volatility, liquidity, and market conditions. You can improve your forex trading performance by taking forex market hours into account and applying these strategies for each key trading session:

Session | Characteristics | Strategy 1 | Strategy 2 |

Tokyo | Typically lower volatility; major pairs like USDJPY and AUDUSD are more active. | Range trading Since the price often moves in a range during this session, traders can identify support and resistance levels to take advantage of price rebounds. | News trading Pay attention to economic data releases from Asia that can affect currency pairs, especially the Japanese yen. |

London | High volatility and liquidity; many major currency pairs are actively traded. | Breakout trading Use this time to identify key support and resistance levels. Breakouts from these levels can lead to significant price movement. | Trend following Capture trends that often become established during this session. Use moving averages or other indicators to confirm trends. |

New York | Similar to the London session in terms of high volatility and ample trading opportunities. | Scalping Take advantage of quick price movements for small profits. Focus on highly liquid pairs, especially during the overlap with the London session. | Momentum trading Look for currencies that are moving strongly in one direction, particularly due to fundamental news releases or market sentiment. |

London / New York (overlap) | The busiest trading time with the highest volume and volatility. | High-frequency trading Employ algorithmic strategies that can execute multiple trades quickly to capitalize on tiny price changes. | Arbitrage opportunities Take advantage of price discrepancies across brokerages or market platforms. |

General tips

Adapt to market conditions. Each session behaves differently, so be flexible with your strategies based on current market conditions.

Monitor news calendars. Economic releases and geopolitical events can impact volatility heavily, so always be aware of scheduled news.

Use technical analysis. Incorporate various technical indicators and chart patterns that suit the specific session’s characteristics.

How session overlaps affect market behavior

Overlaps in forex market hours have a significant impact on market behavior and trading strategies due to increased liquidity, volatility, and the potential for substantial price movements.

Understanding how the overlaps in forex sessions influence market dynamics is crucial for developing effective trading strategies.

Here are some key ways forex session overlaps affect the market:

Increased liquidity

During overlaps, more traders are active in the market, which leads to higher trading volumes. This increased liquidity can reduce spreads (the difference between bid and ask prices), making it cheaper to enter and exit trades.

Higher volatility

With more participants in the market, especially large institutional players, there is often greater price movement. This heightened volatility can create opportunities for traders to capitalize on rapid fluctuations but also increases risk.

Potential for breakouts

Overlaps often see breakouts from established price ranges, as traders react to news and market sentiment. Traders can implement breakout strategies to enter positions when the price moves beyond support or resistance levels.

Trend continuation

During overlaps, trends that began in one session may continue into the next. Traders can employ trend-following strategies, using indicators like moving averages to capture continued momentum.

News reaction

Economic releases often coincide with overlaps, leading to abrupt changes in market sentiment. Traders need to be aware of the economic calendar and may adopt news trading strategies to take advantage of profits resulting from economic data releases.

Informed trading decisions

The presence of multiple market centers can lead to more information available and diverse opinions influencing prices. Traders can use this knowledge to make more informed decisions regarding timing and execution of trades.

Arbitrage opportunities

With different prices for the same currency pair across various platforms or regions during overlaps, traders might find arbitrage opportunities where they can buy low on one platform and sell high on another.

Trading strategies for overlaps:

Scalping

Taking quick trades to benefit from small price movements due to increased volatility.

Range trading

Identifying short-term ranges and exploiting them during periods of high traffic.

Breakout trading

Entering trades after significant price movements beyond defined levels.

Momentum trading

Leveraging the strong price movements often seen during these high-activity periods.

When sessions overlap

The forex market’s four main sessions can overlap, creating times of increased trading activity and peak opportunities for profit. Here are the key overlap periods:

1. London and New York overlap

1:00 PM to 5:00 PM GMT

This is typically the most active period of the 24-hour period for forex trading, with high volatility and liquidity because both major financial centers are open.

2. London and Tokyo overlap

8:00 AM to 9:00 AM GMT

This overlap is shorter and less volatile than the London-New York overlap but still sees increased activity.

3. Sydney and Tokyo overlap

12:00 AM to 7:00 AM GMT

This overlap can lead to some increased trading, especially for pairs involving the Australian dollar and the Japanese yen.

Forex traders often tailor their strategies to take advantage of specific trading session times and overlaps to optimize their profits. Here are some strategies that can be employed during various forex market hours:

1. Breakout Trading

Description

This strategy involves identifying key support and resistance levels and placing trades when the price breaks through these points.

Application during overlaps

During overlaps — like the London / New York overlap — traders can expect significant price movements. When the price breaks above resistance or below support, traders enter positions in the direction of the breakout.

Tools

Use technical indicators such as Bollinger Bands or trend lines to identify breakouts.

2. Scalping

Description

Scalping is a short-term strategy that involves making a large number of trades to capture small price movements.

Application during overlaps

The increased volatility and liquidity during session overlaps create ideal conditions for scalping. Traders can exploit small fluctuations in price with tight spreads, aiming for quick profits.

Tools

Use a 1-minute or 5-minute chart with indicators like the RSI or moving averages to find entry and exit points rapidly.

3. Trend following

Description

This strategy capitalizes on existing market trends, aiming to enter trades in the direction of the prevailing market movement.

Application during overlaps

During periods of high activity like the London and New York overlap, strong trends may form. Traders look for confirmation signals (like moving average crossovers) to enter trades that follow the trend.

Tools

Trend indicators such as the moving average convergence divergence (MACD) and average directional index (ADX) can help assess and follow trends.

4. Range trading

Description

Range trading involves identifying levels of support and resistance and buying and selling at these levels.

Application during session times

In the Asian session where volatility is usually lower, traders can identify stable ranges to trade within. During overlaps, if prices break a key range level, traders can adjust their strategy from range trading to breakout trading.

Tools

Use non-expanding indicators like the relative strength index (RSI) to identify overbought or oversold conditions within the range.

5. News trading

Description

This strategy emphasizes trading based on economic news releases that significantly impact market movements.

Application during overlaps

Many important economic data releases, such as the U.S. non-farm payrolls or ECB announcements, often coincide with session overlaps. Traders prepare for volatility spikes by analyzing economic indicators and positioning themselves to benefit from the resultant price movements.

Tools

Economic calendars, sentiment analysis, and pre-market volatility indicators help traders gauge potential market reactions.

6. Arbitrage trading

Description

Arbitrage involves simultaneously buying and selling a currency across different markets to profit from price discrepancies.

Application during overlaps

When markets overlap, price differences between brokers or exchanges can create arbitrage opportunities. Traders must act quickly to exploit these discrepancies before they disappear.

Tools

Automated trading systems can help execute rapid trades to capitalize on small price differences.

7. Swing trading

Description

Swing trading aims to capture price swings over a few days or weeks. Traders look for short-term patterns that indicate potential reversals or continuations.

Application during overlaps

Enter trades based on larger price movements during overlaps, using technical analysis to identify swing points. This can capture pips offered by more extended price actions.

Tools

Candlestick patterns, Fibonacci retracement levels, and trend lines can aid in identifying potential swing points.