What are bid and ask prices?

Bid and ask prices are fundamental concepts in trading and financial markets, particularly in the context of stocks, currencies, and other securities.

Bid price

The bid price is the highest price that a buyer is willing to pay for a security at a given time. When you sell a security, the money you receive is the bid price. It reflects the demand for that security — the higher the bid, the more buyers are willing to pay.

Ask price

The ask price, also known as the offer price, is the lowest price that a seller is willing to accept for a security. When you buy a security, you pay the ask price. This price reflects the supply of the security — the lower the ask, the more sellers are willing to sell.

The difference between the bid and ask prices is known as the spread, and it represents the transaction cost of trading that security. A narrower spread often indicates a more liquid market, while a wider spread can indicate less liquidity. These prices can fluctuate based on market conditions, supply and demand, and other factors influencing trading.

Bid & ask — what are the differences?

These differences are crucial for traders and investors to understand as they impact buying and selling decisions in financial markets.

Bid price

The highest price a buyer is willing to pay for a security.

Represents demand in the market; it's where potential buyers place their orders.

When selling a security, you will receive the bid price.

Can increase when demand for a security rises.

If demand decreases, bid prices may fall.

Ask price

The lowest price a seller is willing to accept for a security.

Represents supply in the market; it's where potential sellers place their orders.

When buying a security, you will pay the ask price.

Ask prices can decrease when supply exceeds demand.

If sellers are eager to sell, ask prices may rise.

More about spread

Spread refers to the difference between the bid price and the ask price of a security in financial markets. It serves as a key indicator of market liquidity and transaction costs. Understanding spread is essential for the trader to keep down trading costs. This breakdown will explain in detail:

1. Components of spread

Bid price

The highest price a buyer is willing to pay for a security.

Ask price

The lowest price a seller is willing to accept for a security.

Spread

Calculated as:

Spread = Ask price – Bid price

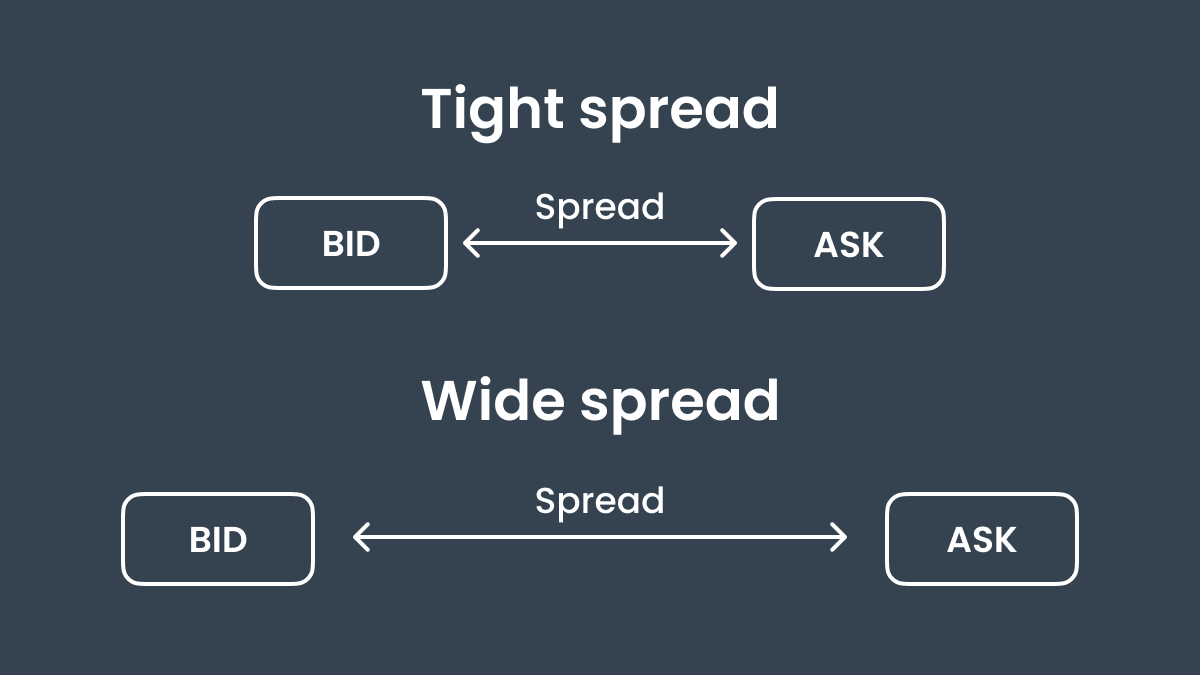

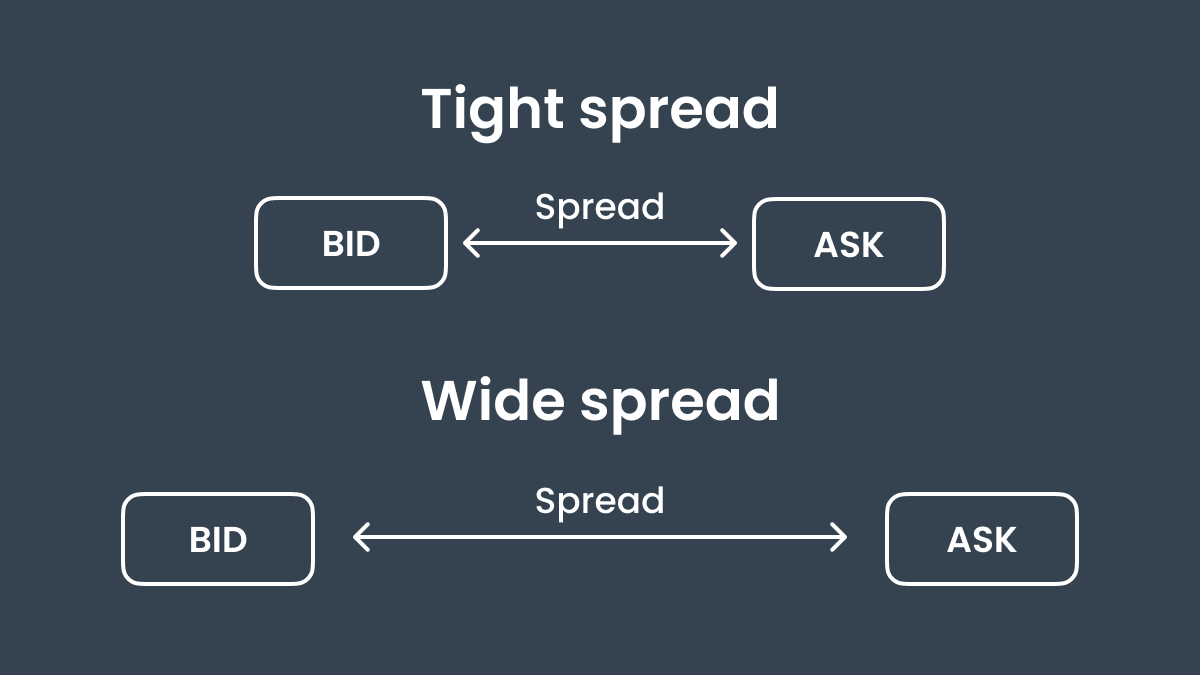

2. Types of spread

Tight spread

A small difference between the bid and ask prices, indicating high liquidity and active trading in the security. This means that buyers and sellers are closely matched in their price expectations.

Wide spread

A larger difference between the bid and ask prices can indicate lower liquidity, less market activity, or higher uncertainty about the security's value.

3. Impact of spread on trading

The spread represents the transaction cost for traders; it is essentially the minimum profit (or loss) a trader must account for when buying and selling a security.

When you place a buy order, you do so at the ask price, and when you sell, you do so at the bid price. The spread can thus affect the profitability of trading strategies, especially for short-term traders or high-frequency traders.

4. Factors influencing spread

Liquidity

More liquid securities (like major stocks or currencies) tend to have tighter spreads, while less liquid or more volatile securities may exhibit wider spreads.

Market conditions

Economic news, market events, or changes in supply and demand can influence spread sizes.

Time of day

Spreads can vary throughout the trading day; they may be tighter during active trading hours and wider during off-hours or periods of low activity.

Understanding the spread is essential for traders and investors as it can significantly influence their trading decisions and overall costs.

What the bid-ask spread shows us about the market

The bid-ask spread provides valuable insights into various aspects of a financial market and the specific security being traded. It is a useful indicator of market conditions, liquidity, trading costs, and overall investor sentiment. Traders and investors often monitor the spread to inform their trading strategies and assess the viability of entering or exiting positions in the market.

Here are several key insights that a bid-ask spread can indicate:

Liquidity

A narrower spread generally indicates higher liquidity, meaning there are many buyers and sellers actively trading the security. Conversely, a wider spread suggests lower liquidity, which can indicate that fewer participants are willing to trade at any given time.

Market activity

A tight spread may suggest high trading activity and competition among traders to buy and sell the security. A wider spread often reflects reduced market interest or trading activity.

Transaction costs

The spread represents a transaction cost for traders. A wider spread means higher costs for entering and exiting positions, which can influence trading strategies and profitability.

Price volatility

Wider spreads can be associated with increased price volatility or uncertainty regarding the future price of a security. In times of market stress or significant news, spreads tend to widen as traders become more cautious.

Market sentiment

Changes in the spread can reflect shifts in market sentiment. For example, if the spread widens suddenly, it may signify uncertainty or apprehension among traders, while a narrowing spread can suggest confidence or a consensus on the security’s price.

Demand and supply

The relationship between the bid and ask prices within the spread highlights the balance of supply and demand for the security. An imbalance can lead to price movements.